Our take on the latest Consumers price index (Mon 21 Jul 2025)

Prices up 0.5% in June quarter

Non-tradable inflation eases to 3.7%pa

Prevalence of price falls and discounting suggests underlying pressures are easing

The key numbers...

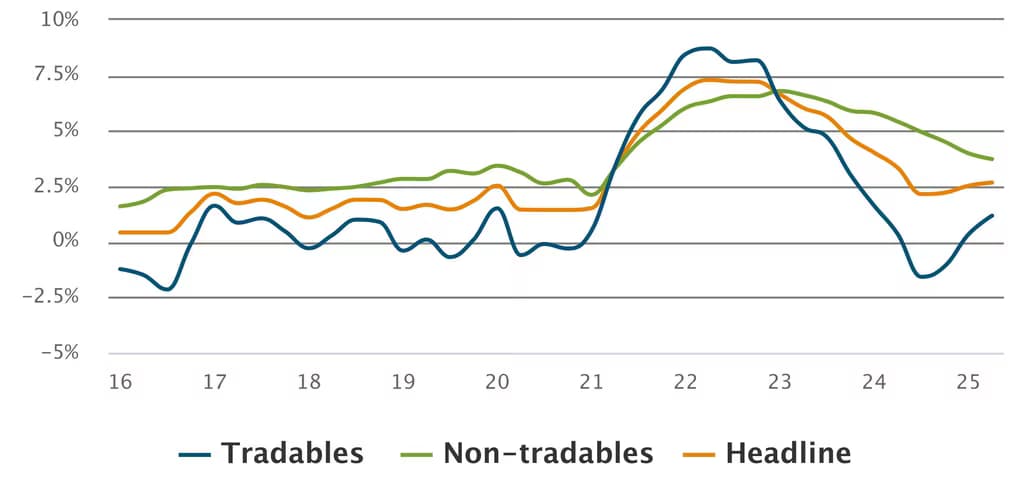

- Inflation pushed up to a 12-month high of 2.7%pa in the June quarter, which was slightly below market expectations of a 2.8% increase, and a little above the 2.6%pa rate predicted by us and the Reserve Bank.

- Non-tradable inflation eased to 3.7%pa, the slowest rate in four years, suggesting that domestic price pressures are continuing to moderate.

- The largest contributors to last quarter’s price rises were cultural services (up 9.5%, due to higher prices for TV streaming services), electricity (up 4.9%, the biggest quarterly increase since 1988), and vegetables (up 10%, which was partly seasonal, but also underpinned by larger-than-normal rises for tomatoes, cucumbers, and beans).

- Petrol prices fell 4.8% over the quarter to their lowest level since June 2023 (when fuel excise duty was still 29c/L lower than usual). Domestic accommodation prices fell 9.6% from the March quarter, reflecting seasonal tourism patterns, and they were still up 1.6% from June 2024.

- Rents were up 3.2% from a year ago, the smallest annual increase in four years. South Island rental growth remains stronger, at 5.0%pa, but Auckland’s rental inflation was 2.5%pa, and Wellington’s rental inflation eased to a 13-year low of 1.1%pa.

- The proportion of the CPI that recorded quarterly price increases was 55%, the lowest since the COVID-19 lockdown in June 2020. Perhaps even more critically, 36% of the CPI recorded a decline in prices, which was the largest proportion to record a fall since 2014.

Moderation in non-tradable inflation is reassuring

CPI components, annual % changes

...and our reaction

- Today’s acceleration in headline inflation was largely expected. However, the Reserve Bank is likely to be pleased with the continuing moderating trend in domestic (non-tradable) inflation, which remains on track to slow to 3.0%pa by mid-2026.

- The larger proportion of items falling in price points towards the effects of weak demand and spare capacity across the economy. Discounting was particularly prevalent for private transport supplies and services, footwear, small electrical household appliances, furniture and furnishings, and carpets and other floor coverings.

- Although lower petrol prices are welcome relief, households continue to be slapped around by significant price rises for many food items, electricity and gas, and local authority rates (with the next annual increase to be captured in the September quarter). These price increases for essentials are likely to continue to limit growth in discretionary spending in the near term.

- Weak rental growth across the North Island reflects weaker net migration and a lack of employment growth. It also suggests it will be difficult for the housing market to stage a strong recovery in the near-term.

- Today’s data is unlikely to change the Reserve Bank’s thinking ahead of next month’s Monetary Policy Statement. We continue to expect the official cash rate to be cut to 3% in August, with little or no scope for further cuts after that. Labour market data, to be published on 6 August, could still affect next month’s interest rate decision, as could other high-frequency data.

Latest updates

Premium

Consumers price index

Inflation breaches the RBNZ upper band

Fri 23 Jan 2026

Quarterly

Premium

Consumers price index

Inflation rises to 3.0%pa, hits top of the Reserve Bank's band

Mon 20 Oct 2025

Quarterly

Consumers price index

Inflation rises to 2.5%pa, imported inflation pressures reappear

Thu 17 Apr 2025

Quarterly