Real estate statistics

Number of new listings keeps a lid on the housing market

17 Nov 2025

Our take on the latest Real estate statistics (Mon 17 Nov 2025)

House prices unchanged from September (sa)

House sales up 3.6% from September (sa)

Stock of properties for sale up 1.9% from September (sa)

The key numbers...

- House prices were unchanged in October from September (seasonally adjusted). House prices remain slightly up from a year ago, 0.3% higher than in October 2024.

- House sales rose 3.6% in October from September (seasonally adjusted), and up 6.4% from a year ago. Annual sales volumes are at their highest since the year to March 2022.

- The stock of properties available for sale rose 1.9% from September, increasing for the third consecutive month. The number of new listings rose 5.4% from September to the highest monthly total since December 2024. The number of properties available for sale remains at a more than 10-year high (all figures seasonally adjusted).

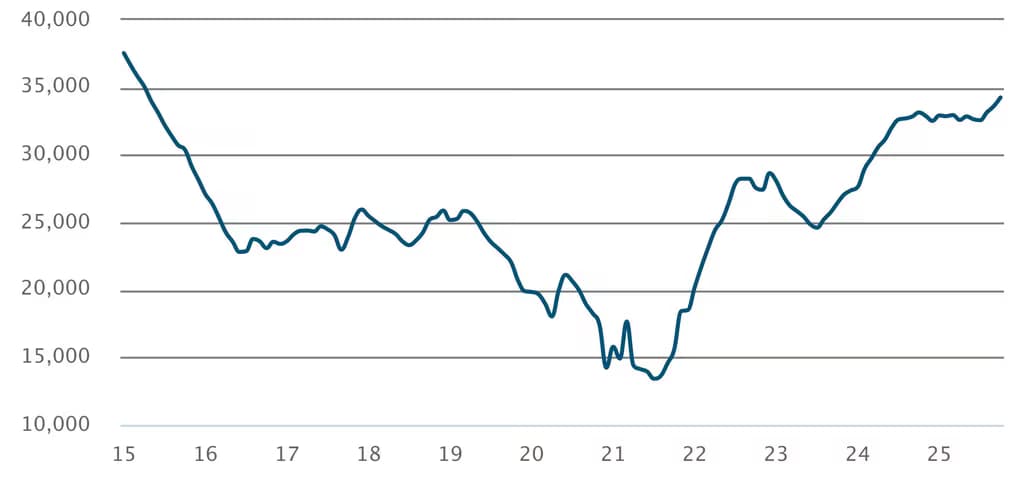

Stock for sale still rising

New Zealand based listings on realestate.co.nz, seasonally adjusted

...and our reaction

- House price declines in the capital had appeared to be moderating in July and August, as the annual decline was the smallest in almost 12 months. However, the decline in Wellington has reaccelerated over the past two months, and house prices are now 2.9% lower than a year ago. Only Marlborough (-4.1%) has seen a larger decline over the same period.

- The median length of time to sell rose by one day to 45 days (seasonally adjusted). Time to sell has lacked any real trend in 2025, with the surplus of stock available for sale driving a lack of buyer competition in the market and keeping the length of time to sell elevated.

- In September, there were some shifting trends in new fixed term mortgage lending choices, as six-month fixed lending’s share rose to 18% of all new mortgages (excluding floating options). Six-month’s share of lending had fallen significantly as we were approaching the expected end of interest rate cuts, but it rose to its highest share since February, with the shift likely to be related to the Reserve Bank's August Monetary Policy Statement, where the Bank signalled further cuts. One-year fixed rate mortgages were steady at a 53% share of all new fixed term lending.

Latest updates

Premium

Real estate statistics

House prices end the year in the red

Thu 22 Jan 2026

Monthly

Premium

Real estate statistics

House sales slow in November

Tue 16 Dec 2025

Monthly

Real estate statistics

Surplus of properties for sale restricts price growth

Tue 14 Oct 2025

Monthly