Our take on the latest Employment indicators (Fri 28 Nov 2025)

Filled jobs unchanged in October (sa)

Primary industries jobs up 0.5% in October (sa)

Service industry jobs unchanged from a year ago

The key numbers...

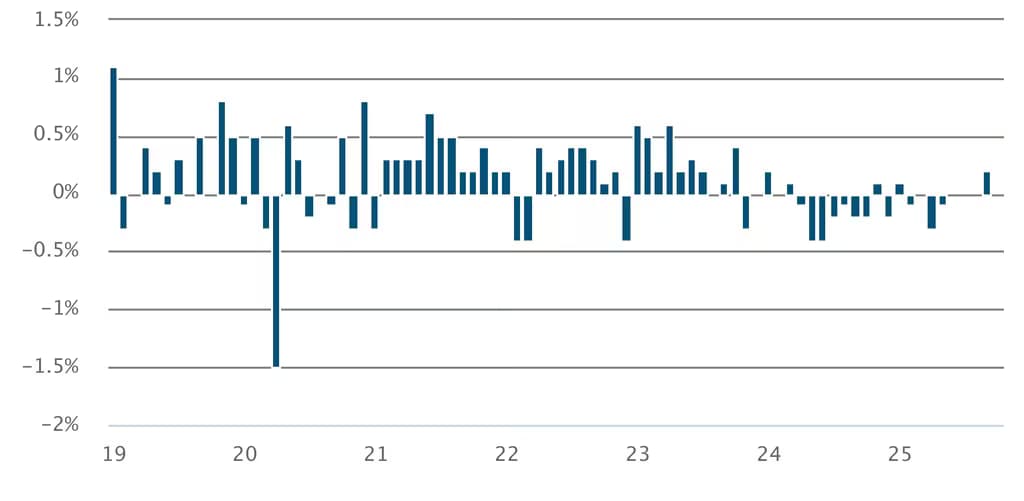

- Filled job numbers were unchanged in October from September. Filled job numbers have been unchanged in four of the last five months now after revisions to previous results. This series tends to be revised lower in future releases so there is a chance that October’s flat result is revised to a fall (all figures seasonally adjusted).

- Primary industries filled jobs rose 0.5% in October from September (seasonally adjusted), and were up 0.5% from a year ago, the only one of the three broad sectors to see an annual rise.

- Service industry filled jobs were unchanged in October from September (seasonally adjusted), and were also unchanged from a year ago, breaking the streak of annual falls which have prevailed since July 2024.

- At an industry level, outside of mining (+6.7%), the largest annual increases in filled jobs were largely across public sector roles. Public administration (+2.2%) saw its largest increase since mid-2024. Healthcare (+1.7%) and education (1.3%) filled jobs remain higher than a year ago as well.

Not a lot of movement in filled jobs

Filled jobs, monthly % change, seasonally adjusted

...and our reaction

- Goods-producing industries filled jobs were the only broad sector down on a year ago, down 2.8%pa. However, ANZ’s Business Outlook survey for November showed signs of confidence picking up in the manufacturing sector, as business confidence in the sector rose to a record high (data since April 1988, not seasonally adjusted). The pick up in confidence bodes well for a turnaround in goods-producing filled jobs in 2026.

- Outside of the monthly employment indicators, are tentative signs of improvement in the labour market through partial indicators of employment. The number of hours worked in the Household Labour Force Survey (HLFS) released earlier this month rose 0.9% from the previous quarter, increasing for the first time since December 2023 (seasonally adjusted). Broader employment levels were flat, indicating that businesses may be increasing hours for existing workers before looking to add to their headcount.

- The Reserve Bank’s November 2025 Monetary Policy Statement highlighted just how difficult it has been for unemployed individuals to find a job in the current labour market, with the job finding rate at its lowest level in 30 years. Although relative to other economic cycles, the current unemployment rate of 5.3% is less severe, vacancies and job transitions are low, making it hard for those who have become unemployed to transition back into work. This might be a function of businesses doing their best to hold on to staff, with the recent period post-pandemic labour shortages still playing on their minds, when it was hard to find workers.

Latest updates

Premium

Employment indicators

Filled jobs flatline in December

Wed 28 Jan 2026

Monthly

Premium

Employment indicators

Encouraging increase in November filled jobs

Wed 14 Jan 2026

Monthly

Employment indicators

Filled jobs rise again in September

Tue 28 Oct 2025

Monthly